Swiss National Bank grew its stake in Builders FirstSource, Inc. (NASDAQ:BLDR) by 1.6% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 224,600 shares of the company’s stock after purchasing an additional 3,500 shares during the period. Swiss National Bank owned about 0.19% of Builders FirstSource worth $2,747,000 at the end of the most recent quarter.

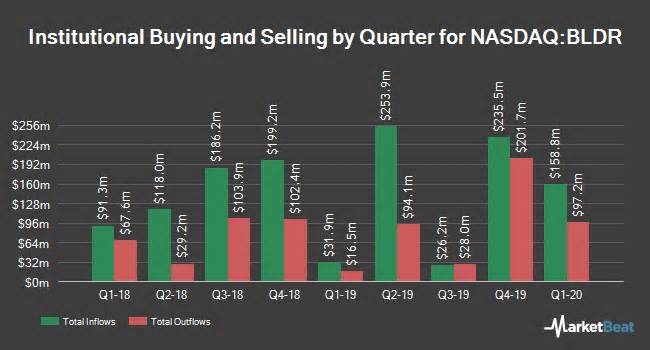

Several other hedge funds and other institutional investors have also recently modified their holdings of the company. Ladenburg Thalmann Financial Services Inc. lifted its stake in shares of Builders FirstSource by 1,056.5% in the 4th quarter. Ladenburg Thalmann Financial Services Inc. now owns 983 shares of the company’s stock valued at $25,000 after purchasing an additional 898 shares during the period. Anderson Fisher LLC acquired a new stake in Builders FirstSource during the fourth quarter valued at $26,000. Point72 Hong Kong Ltd purchased a new position in Builders FirstSource in the fourth quarter valued at $49,000. Advisory Services Network LLC raised its position in shares of Builders FirstSource by 80.0% in the fourth quarter. Advisory Services Network LLC now owns 2,970 shares of the company’s stock worth $75,000 after acquiring an additional 1,320 shares during the period. Finally, KBC Group NV purchased a new stake in shares of Builders FirstSource during the 1st quarter worth about $41,000. 98.59% of the stock is currently owned by institutional investors and hedge funds.

A number of research firms recently weighed in on BLDR. SunTrust Banks reduced their price target on Builders FirstSource from $30.00 to $17.00 and set a “buy” rating for the company in a report on Thursday, April 16th. Royal Bank of Canada reaffirmed a “buy” rating and set a $20.00 target price on shares of Builders FirstSource in a research note on Sunday, May 3rd. Benchmark dropped their price target on shares of Builders FirstSource from $32.00 to $22.00 and set a “buy” rating on the stock in a research note on Monday, May 4th. DA Davidson reissued a “buy” rating and issued a $20.00 price target (down previously from $33.00) on shares of Builders FirstSource in a report on Thursday, April 9th. Finally, B. Riley decreased their price objective on shares of Builders FirstSource from $16.00 to $14.00 and set a “neutral” rating on the stock in a report on Monday, May 4th. One research analyst has rated the stock with a sell rating, five have given a hold rating and eleven have issued a buy rating to the company’s stock. The stock presently has a consensus rating of “Buy” and a consensus target price of $21.50.

In other Builders FirstSource news, Director Floyd F. Sherman sold 45,903 shares of Builders FirstSource stock in a transaction dated Friday, May 15th. The shares were sold at an average price of $16.05, for a total transaction of $736,743.15. Following the transaction, the director now directly owns 147,771 shares of the company’s stock, valued at $2,371,724.55. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Floyd F. Sherman sold 14,097 shares of the business’s stock in a transaction dated Monday, May 18th. The shares were sold at an average price of $17.75, for a total transaction of $250,221.75. Following the completion of the transaction, the director now owns 147,771 shares in the company, valued at $2,622,935.25. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 63,000 shares of company stock valued at $1,044,415. 1.80% of the stock is owned by company insiders.

BLDR stock opened at $21.50 on Wednesday. The company has a current ratio of 1.87, a quick ratio of 1.12 and a debt-to-equity ratio of 1.85. The firm has a 50-day moving average of $17.02 and a two-hundred day moving average of $21.43. Builders FirstSource, Inc. has a 12 month low of $9.00 and a 12 month high of $28.43. The company has a market cap of $2.51 billion, a price-to-earnings ratio of 12.95 and a beta of 2.47.

Builders FirstSource (NASDAQ:BLDR) last posted its quarterly earnings results on Thursday, April 30th. The company reported $0.34 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.28 by $0.06. Builders FirstSource had a return on equity of 31.26% and a net margin of 2.62%. The business had revenue of $1.79 billion during the quarter, compared to analyst estimates of $1.77 billion. During the same period in the prior year, the business earned $0.34 earnings per share. The business’s revenue was up 9.5% compared to the same quarter last year. As a group, equities analysts forecast that Builders FirstSource, Inc. will post 1.02 earnings per share for the current year.

Builders Pervyshin company Profile

Builders FirstSource, Inc manufactures and supplies building materials, manufactured components, and construction services to professional homebuilders, sub-contractors, remodelers, and consumers in the United States. The company operates through four segments: Northeast, Southeast, South, and West. It offers lumber and lumber sheet goods comprising dimensional lumber, plywood, and oriented strand board products that are used in on-site house framing; manufactured products, such as wood floor and roof trusses, steel roof trusses, wall panels, stairs, and engineered wood products; and windows, and interior and exterior door units, as well as interior trims and custom products under the Synboard brand name.

Recommended Story: Stock Portfolio Tracker

Swiss national Bank purchases of 700 shares Axsome Therapeutics Inc (NASDA: AXSM)

$0.03 EPS is Expected to Carter Bank and trust (NASDA: CARE) IN this quarter

Be the first to comment on "The Swiss national Bank increases stake in builders FirstSource, Inc. (OF NASDS: BLDR)"