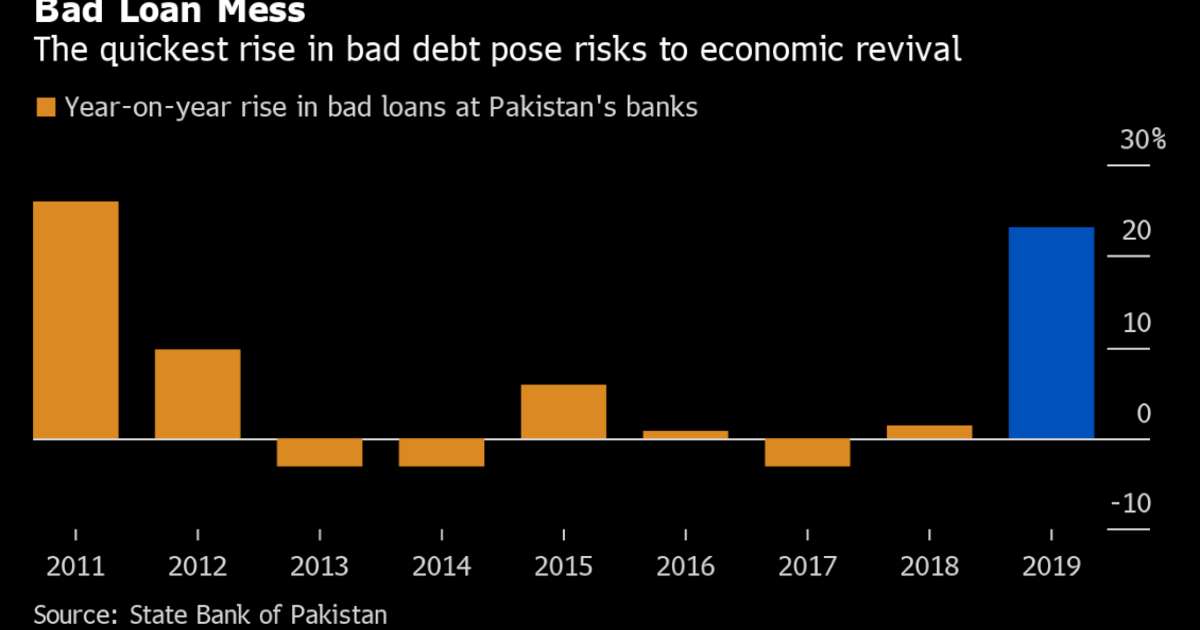

(Bloomberg) — a Rapid economic recovery could elude Pakistan’s economy as delinquent debt at the country’s banks increases at the fastest pace in eight years, limiting their ability to stimulate lending.

Total bad debt rose 23 percent in the year to June 30, while annual credit growth fell to a four-year low, data compiled by Pakistan’s Central Bank showed. The deterioration in asset quality could continue as companies across the Board – from Toyota’s local unit to Power Cement Ltd. – are cutting production while others, including Nestle SA’s Pakistan division, are cutting their workforce.

Interest rates, which have more than doubled to 13.25% since the start of 2018, are exacerbating asset quality problems, undermining borrowers ‘ ability to repay. The government estimates economic growth to fall to 2.4%, the slowest pace in a decade, in the year started in July.

Contact the editors responsible for this story: Arijit Ghosh at [email protected], Anton Antony, Ravil Shirodkar

For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L. P.

Like us on Facebook to see similar stories

Be the first to comment on "Surge in bad loans poses new risks to Pakistan’s economic revival"