A handful of corporations nicknamed the German reaction to the “Seven Magnificent” American have a strong resumption of the country’s inventory marketplace this year, defying the gloom that envelops the national economy.

Frankfurt’s Dax, an index of 40 blue-chips, has risen 18.7 per cent this year, beating the benchmarks in France and the UK, and far outstripping the region-wide Stoxx Europe 600 index’s 4.8 per cent gain.

The effects come despite weak domestic expansion and political turmoil, with Germany’s unpopular coalition government collapsing in November after parties failed to reach an agreement on tax reforms to “curb debt,” and the country now heading for snap elections in 2017.

At the same time, the economy is expected to grow only 0. 6 in 2025, below the forecast of 1. 2 in the middle of the year, according to the economists surveyed through the consensus economy. This is the greatest relief in the projected expansion on an era of any primary commercial economy.

The functionality of the Dax “was a surprise,” said Timothy Lewis, portfolio manager of JPMorgan Asset Management, and “is a wonderful example of the adage that the inventory market and economic functionality are the same. “

Dax constituents derive less than a quarter of their earnings from within Germany, which has helped provide a buffer against tremors that have, for instance, seen automotive giant Volkswagen set out plans to lay off tens of thousands of workers and shutter several factories.

Some content can be loaded. Check the Internet connection or browser settings.

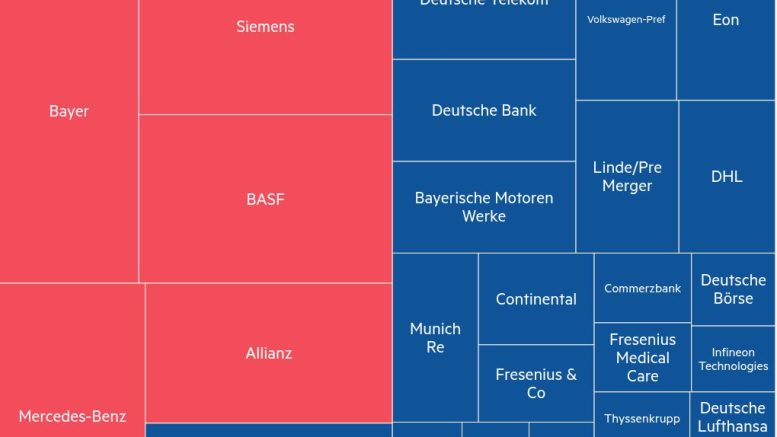

The excellent yields of this year’s stocks were largely due to seven companies: the SAP software giant, Rheinmetall defense actions, the Siemens, Siemens Energy, Deutsche Telekom and insurers Allianz and Munich Re.

SAP accounts for nearly 40% of Dax’s revenue, and its moves increased by more than 70% as its professional customers transitioned to the cloud. It accounts for a larger share of the index than the auto sector, adding Volkswagen and Mercedes-Benz, both of which are in the red this year.

SAP has benefited from the market’s huge appetite this year for stocks with exposure to artificial intelligence. To that end, it has moved its earnings publication times from European mornings to after the US market close, to give it more exposure to North American investors and analysts. In October it replaced Dutch semiconductor equipment manufacturer ASML as Europe’s largest technology company.

“Tech stocks have been the story of this year and, unfortunately, in Europe we have two major players: ASML and SAP,” said Marc Halperin, co-head of European equities at Edmond de Rothschild, a leading asset manager. the cake is AI. “

The seven corporations that fueled gains on the DAX benefited from a variety of tailwinds, with defense firm Rheinmetall soaring 107% this year on the back of developing expectations for higher defense spending in Europe, while Siemens Energy gained 329% due to the development of a call for the development of renewable energy.

Some content can be uploaded. Check your internet connection or browser settings.

Guillaume Jaisson, Goldman Sachs macroeconomic strategist, said the market tells “two other stories”, market leaders – those who compare with the magnificent seven technological values of Wall Street – ahead of an organization of exporters vulnerable to a client low Chinese. and the imaginable US customs tariffs.

A euro decrease also stimulated the German export market, which had more than € 1. 11 to € 1. 04 from the end of September.

Some investors and analysts are concerned about the growing reliance on the benchmark index for a small number of stocks.

“This jeopardizes a volatile market,” said Arne Rutenberg, portfolio manager at Union Investment, who believes the market will be affected by an SAP profile.

The election of a new government and possible adjustments to the debt brake of Germany, the plans of the elected president of the United States, Donald Trump for the price lists or the national economic stimulus measures of China, can simply “change things very Quickly “for the market, he added.

Halperin added that he had recently followed a position in SAP that was smaller than the benchmark index when earnings expectations began to take off at the summits of his U. S. peers.

The narrowness of the Dax rally has worsened in recent years, a trend that had been installed after the pandemic and that reflects the fears of the United States on the role of some giant technological corporations in the impulse of returns to the rear of the Ia. Requires.

The content may simply not load. Check your browser connection settings.

The production giant Tamin, Nvidia, for example, represents approximately a quarter of the profits of the S&P 500 reference index this year.

But many fund managers remain positive about clients for German stocks that the industry at steep discounts to their opposite U. S. numbers. U. S. And you get a significant portion of your profits from outside the gates of your local market.

Marc Schartz, portfolio manager at Janus Henderson, said DAX’s “pretty extreme” but prolonged concentration on energy, telecommunications and insurance, unlike the United States, which only concentrates on generation stocks. “Having a more diverse set of corporations driving markets is not a bad thing,” he said.

“The corporations we invest in are pan-European. It’s just coincidence that they’re indexed in a secure zip code,” Schartz added.

Additional reporting via Ray Douglas in London

Be the first to comment on "Germany’s own ‘magnificent seven’ help Dax defy bleak growth outlook"