Economic forecasts for 2025 point to growth, although at a slower pace than in 2024. Inflation will remain above the Federal Reserve’s target as President-elect Trump’s policies restrict production while increasing spending . The biggest threat is a recession, but constrained productive capacity as immigration declines.

The U. S. economy has performed well through 2024. The past two quarters in particular have grown faster than the long-term average, and the Atlanta Federal Reserve’s GDPNow estimate for the fourth quarter continues the above-average trend. Employment has risen every month this year (although we don’t have data for December 2024 yet).

Consumer spending rose nicely, up nearly four percent over the past 12 months after adjusting for inflation. Most everyone who wants a job has one, and wages are now rising faster than inflation. Although consumer borrowing is not growing rapidly, household bank balances remain elevated thanks to those stimulus checks that went out during the pandemic. This will be the bright sector for 2025’s economy.

Construction across all sectors has been roughly flat, with the surge in data centers and semiconductor fabrication plants offsetting declines in residential and commercial building. Business capital spending has also dropped except for fab and data center-related purchases.

Government spending continues to grow rapidly at federal, state and local levels, with some of the state and local gains coming from federal grants.

U. S. exports have remained more or less flat over the beyond year, even as imports have increased. The strong dollar makes U. S. -made products more dear in the eyes of foreigners, whilst imported products seem less dear in the eyes of American consumers and businesses.

The Federal Reserve considers interest rates restrictive. In other words, they are higher than the unbiased interest rate, this is not observable. In fact, rising interest rates since 2021 have depressed the structure and perhaps some of the business capital spending as well.

Combining all of those factors, the U. S. economy is entering the new year with very smart momentum overall, even if some sectors appear to have wonderful strength.

Labor supply will constitute the greatest limitation on economic growth in 2025. Total spending should be fine, given the momentum with which we enter 2025 and continued federal government spending. Interest rates are probably a little restrictive to overall economic growth. Overall, spending should be completely adequate to keep the economy producing at its capacity.

So instead of thinking of the forecast through a Keynesian lens—how much spending will grow—we must think of 2025 growth through a supply-side lens: how much can the U.S. economy produce?

Productivity (production consistent with are consistent) is adjusted gradually, so in the short run the source of hard work will be inflation-adjusted output. Overspending will only increase inflation.

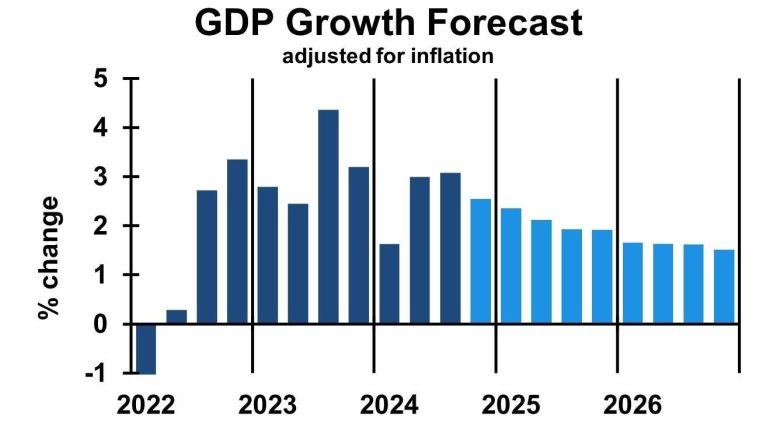

Immigration has led to a significant increase in work over the past two years, but President Trump will begin cracking down on border crossings after his inauguration. This will reduce the rate of economic expansion. The economy will continue to grow, with some expansion in immigration and productivity, so a recession is unlikely. But the speed of progress will be slower than in the past two years. Inflation-adjusted gross domestic product (GDP) grew by 2. 7% in the four quarters through the third quarter of 2024. This figure will fall to 2. 1% by the end of 2025 and 1. 6% by the end of 2026 The slowdown in expansion will not constitute a recession. After all, the economy continues to grow. But the expansion speed will be lower.

Most companies will not feel the difference between existing expansion rates and long-term expansion. These small adjustments will be offset by adjustments in the company’s demand and supply. However, companies that expand to take advantage of developing economic activity will likely face prices for which there are no compensating revenues.

Inflation will not decrease much in this environment. The Fed had hoped to hit its 2% value accumulation goal, but that didn’t happen in 2024 and probably wouldn’t happen in 2025. The challenge is, simply put, that too many dollars are chasing too few. possessions.

Very slow decline in rates

The Fed may ease short-term interest rates twice, as they currently expect to do, but they want to see some progress on inflation first. If they settle for microscopic evidence, then they will be able to claim movement in the right direction.

Tariffs will complicate Federal Reserve policy. Most economists claim that customs duties cause a one-time increase in the price level, but do not cause a year-over-year increase in the inflation rate. In his latest press conference, Federal Reserve Chairman Jerome Powell referenced studies conducted in 2018 on a policy that “monitors” tariff-induced value accumulation. The Federal Reserve would hypothetically calculate inflation as if stock listings had not increased values and then apply its policy accordingly. This is the Federal Reserve’s maximum likely reaction to rate hikes. If the Federal Reserve finds that U. S. securities listings and retaliatory measures imposed through our trading partners are harming the domestic economy, then it could simply cut interest rates to help the economy rather than raise them to combat the crisis. inflation. One can simply argue that stock listings and retaliation resemble a chain of origin problem, in which case restarting the economy only produces inflation, but the Fed’s modeling in 2018 found otherwise.

Given these considerations, the likely maximum path of interest rates in 2025 is flat, with an imaginable drop of one or two quarters-point.

International conflict poses significant risk to the U.S. economy. Absent big changes, though, the global economy looks stable. The FocusEconomics projections for 2025 and 2026 show global total GDP growing at a very stable pace. (FocusEconomics surveys economists specializing in countries around the world; averages their projections for each country; then sums them up for global or regional projections. Because no one can monitor every important country, this methodology is probably best for a global forecast.)

In fact, conflicts can alter economic forecasts, as is the case with the war between Russia and Ukraine. Appointments between China and Taiwan could explode. And the Middle East remains a prime location for disruption.

Domestically, price lists and retaliation can plunge the US economy into chaos. Supply chains vary, but many are more inflexible than flexible. Common products such as wheat, oil or copper can easily come from other countries when price lists drive up a supplier’s prices. Customized products, on the other hand, pose a serious problem. If an automaker, for example, contracts with a supplier for a specific type of component for an express car model, then it will be difficult to replace suppliers. Many products marketed around the world fall between these two extremes.

Although a trade war would not throw the global economy into recession, one could certainly bring growth to a standstill, with the most effected industries in actual recession.

Reduced immigration is likely and accounted for in the forecast presented above, but mass deportations could trigger a recession. Much economic activity relies on workers with no or questionable work permits. Losing a substantial fraction of that labor force quickly would lead to production declines concentrated in construction, agriculture/food processing and the leisure/hospitality sector. The economy could adjust, but having to do so from a sudden change would be very harmful in the short-run.

Major power outages pose a threat to many businesses. The country’s power networks are less resilient. Underlying disorders may be due to weather conditions, random mechanical failures, or natural disasters. A smart network isolates disruptions, but a weak network spreads outages over a wide area. We are not bad at the level of Cuba, but we closed old, reliable fossil power plants before reliable opportunities were fully ready. The greatest damage would be regional, with express threats to the most electricity-intensive industries.

On the plus side, synthetic intelligence can simply generate consistent output with employees across a number of sectors, adding healthcare, finance, production, and data technology. This would lead to a more inflation-adjusted GDP despite the limited expansion of the hard labor force. However, the positive outlook is not as wonderful as the problematic possibility.

From this perspective, corporations deserve to devote little effort to crafting contingency plans for select economic forecasts and more effort to industry-specific source hazards. These dangers may simply come from new policies similar to price lists and immigration, as well as issues of the chain of origin.

A community. Many voices. Create a free account to share your thoughts.

Our network aims to connect other people through open and thoughtful conversations. We need our readers to share their perspectives and exchange ideas and facts in one space.

To do so, please comply with the posting regulations in our site’s terms of use. Below we summarize some of those key regulations. In short, civilians.

Your post will be rejected if we notice that it seems to contain:

User accounts will be locked if we become aware that users are engaging in:

So how can you be a user?

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site’s Terms of Service.

Be the first to comment on "Economic forecast for 2025 and beyond: growth with continued inflation"