Advertising

Supports

By Daisuke Wakabayashi and Karen Weiss

SAN FRANCISCO-for years, Google and Amazon have stuck to their strengths. Google’s search monopoly and the universe of online services seemed to represent little overlap with Amazon’s e-Commerce Empire.

But as the ambitions of each expand, it becomes inevitably, inevitably clear that the tech giants are heading for a collision course.

On Tuesday, at its annual Google Marketing Live conference, Google unveiled a list of new products designed to help it become a place for shoppers and marketers in hopes of reaching consumers given the cost of making decisions.

Google’s latest move into the core business Amazon is playing as the retail giant is making progress in what has traditionally been the search company’s home turf: digital advertising.

As online Commerce has become synonymous with Amazon, shoppers are starting more of their product searches on the company’s website rather than Google – traditional on the ramp for all things online – and marketers are spending advertising money there.

In 2015, about 54 percent of searches for products on Google, and 46 percent started on Amazon. By 2018, the numbers had flipped, according to marketing Analytics firm Jumpshot.

Google may be synonymous with many things-search, ads, email, even artificial intelligence – but online shopping is not one of them. That doesn’t mean the company isn’t trying.

The company’s shopping site, Google Express, is similar to Amazon’s familiar online marketplace. Whether someone buys an item from, say, 99 Ranch Market and 1-800-Flowers, products are displayed in the same way and payments are processed through Google Pay, the company’s digital payment system. Customers must meet certain minimum costs to get free shipping, which is limited to the United States.

Google’s financial statements do not break out how much the company makes on e-Commerce, and the company will not say how many people use Google Express, but analysts suggest that it is a sliver of Google’s $ 116 billion in annual ad sales.

Amazon, on the other hand, sold $ 277 billion of goods online last year, which analysts estimate accounts for between a third and half of all e-Commerce sales. Amazon’s” other ” business segment, which it says is primarily ads, has brought in $ 10.8 billion in the past 12 months, a tiny amount compared to Google and Facebook’s advertising ventures, but is growing.

“Both of these companies are in the same conclusion from different points of view,” says Juozas Kaziukenas, founder of Marketplace Pulse, a research firm. “For Amazon, it makes sense, because why not? They have all this traffic, and all this interest from brands.”

Amazon did not respond to a request for comment on Google’s new purchase plans.

Two companies that have competed only on the periphery of their business for years now have a number of overlapping interests.

Google Cloud is challenging Amazon Web Services in cloud computing. Amazon Twitch is becoming a popular alternative to Google’s YouTube for online video content. Google Home and Amazon Echo are smart acoustic vessels for competing smart assistants from companies.

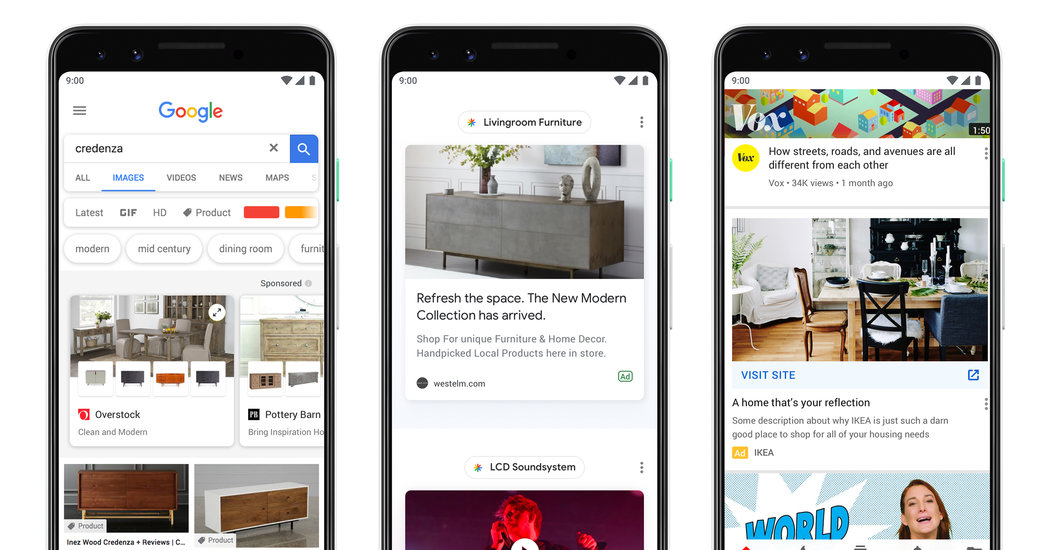

Google said Tuesday that it plans to beef up its e-Commerce with a shopping feature that will allow people to shop directly from YouTube search, images and videos. By clicking ads in these settings, the buyer will buy products through Google.

For users whose credit cards and shipping information is stored with Google, which declined to say how much it is, the company will fill out this information to speed up verification. Google said it wants to make shoppers more comfortable buying from retailers that they may not be familiar with, acting as an intermediary that guarantees a consistent return policy and customer service.

Google also said it plans to introduce new” Discovery ” ads to YouTube, its Discover news, which appears under the search box in the Google app and mobile website, and Gmail later this year. The goal is to target audiences across Google’s various properties using what Google knows about users based on their online search, the videos they watch on YouTube, the websites they browse, and the apps they download.

“Get the Bits newsletter for the latest news from Silicon valley and the tech industry.”

“We’re making more Google shoppable,” said brad Bender, Vice President of product management for the company’s advertising division.

Google has made other efforts to slow Amazon in e-Commerce, with little success. It launched a shopping service in 2013, initially offering free same-day shipping before dropping it. He also tried grocery delivery but gave it up, too.

More recently, Google has spent several years building its Google Express, featuring more than 1,000 retailers, including Best Buy, Costco and Target. As part of its new shopping push, Google said it will create a shopping homepage that is personalized to users.

Google is adding new advertising and shopping products as it tries to quell concerns that its revenue growth has begun to slow.

Last month, Google’s parent company, Alphabet, announced quarterly results that fell short of wall street expectations, dragging down the share price. One of the concerns raised by analysts was that paid clicks on ads on sites like Google and YouTube rose 39 percent, below increases of 50 to 60 percent in recent quarters.

The company is building more tools for brands to place ads on and off its website, and it has added more space to advertise when people search for products.

People can turn to Google to research their interests, but “Amazon is about buying actual goods,” said Brian Wieser, who analyzes media for GroupM, which directs more than $ 48 billion in ads each year on behalf of brands. “You’re actually doing, not just intending to do, so it’s seen as much more rewarding.”

The core of Amazon’s promotional offerings are “sponsored products” lists that direct shoppers to specific items based on the keywords they were looking for. At the top of most search pages, there’s also now a rectangular banner ad called sponsored brand that points shoppers to a company page or to certain products.

Amazon is also quietly building tools to help brands show videos and show ads to consumers on other websites based on the rich data they have on their customers. For example, someone using one Bank’s credit card to pay for Amazon purchases might see ads for another Bank’s cards when reading news online.

Google’s latest move allows the company to sell ads and services that are more closely linked to actual transactions, which they can charge more for.

Mr. Kazukenas said that for now, Google’s plans “are not a risk to Amazon.” The reason, he said, is that Amazon has a big advantage over other retailers after more than a decade of building the infrastructure to ship goods quickly and reliably, while Google is depending on merchants to complete orders on their own.

“Google has historically tried not to do things in the physical world,” Mr. Kaziukenas said. “Obviously, it was very profitable for them.”

An earlier version of this article misspelled the name of the firm’s marketing Analytics. This is a Jumpshot, not a Jumpstart. The article also misspelled that rose 39 percent on sites like Google and YouTube, in line with quarterly results announced by Alphabet last month. These were paid clicks on ads, not the ads themselves.

Follow Deisuke Wakabayashi and Karen Weiss on Twitter: @daiwaka and @KYWieise.

Interested in all things Tech? Get Bits newsletter for the latest from Silicon valley and the tech industry. And subscribe to the personal technology newsletter for advice and tips on technology change as you live.

Advertising

Be the first to comment on "Attention, Amazon Shoppers: Google wants some of your spending money"